DABC's Tax AID program is seeking Volunteer Tax Preparers

Who We Are

Since 1977, Disability Alliance BC (DABC) has been a provincial, cross-disability voice in British Columbia. We champion issues impacting the lives of people with disabilities through our direct services, community partnerships, advocacy, research, and publications.

Our mission: to support people, with all disabilities, to live with dignity, independence, and as equal and full participants in the community.

Program Description

Tax AID DABC partners with the Together Against Poverty Society, the Ki-Low-Na Friendship Society, and the Active Support Against Poverty Society, to provide free support to people with disabilities across BC to file their taxes.

Job Description

DABC is seeking several volunteers who are passionate about community work to join our Tax AID program, year-round. Volunteers will work one-on-one to assist people with disabilities with their income taxes, with supervision of the Senior Tax Advocate. Volunteers will work remotely and will be able to set their own schedule.

Skills and Assets

Successful Volunteers must have:

- 1-2 years of experience with client tax filling

- Good computer and technology skills; (Microsoft Office Suite, experience working with UFile is an asset)

- Excellent attention to detail

- Excellent communication and interpersonal skills

- A strong desire to help and serve our community of people with disabilities

- An ability to maintain strict confidentiality

Successful Volunteers must also be able to:

- Pass a Criminal Record Check

- Obtain an EFILE number (personal tax filings are current; no outstanding tax debt; not in bankruptcy)

Duties

- Complete income tax returns in accordance with Revenue Canada guidelines

- Report questions or concerns to the Income Tax Clinic supervisor

Benefits of Volunteering

- Help individuals get or maintain uninterrupted access to benefits and credits

- Give back to the community

- Increase personal tax knowledge

- Gain new skills and improve existing ones

- Receive training, support, and reference materials including free tax software

Training and Orientation

- Orientation to Tax AID DABC programs, policies, and procedures

- Canada Revenue Agency online webinars

- Virtual supervision by Income Tax Clinic supervisor

Application Deadline: rolling application until all spots are filled

If you are interested in applying, please submit a resume to Cynthia Minh, Director, Tax AID, cynthia@disabilityalliancebc.org (Please indicate “Volunteer Tax Preparer” in the email subject line).

Provide your input: Renfrew/Rupert Station Area Plan

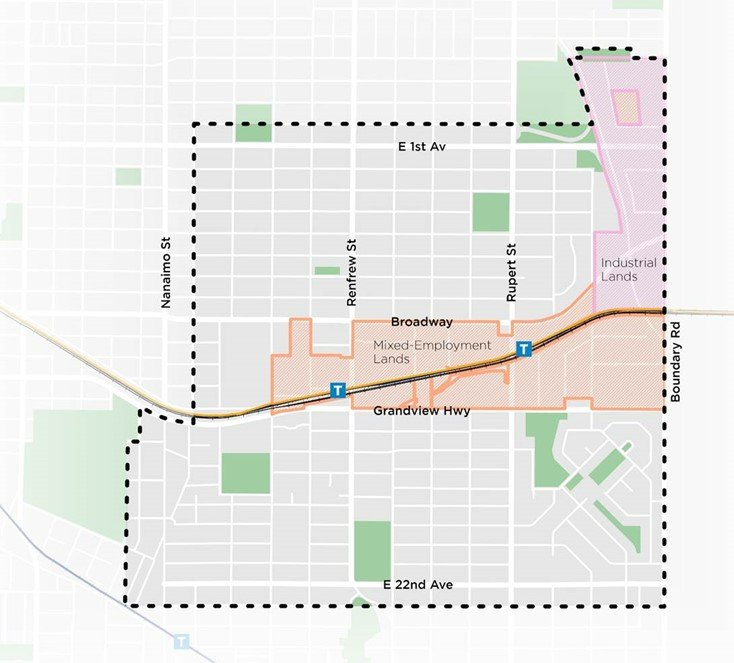

Do you live or work near Rupert or Renfrew Skytrain stations in Vancouver? If so, the City of Vancouver is starting a new area plan around the Rupert and Renfrew SkyTrain stations and they would like you to provide your input by attending an on-line workshop on June 27 from 10-11:30 am. A $40 honourarium will be provided. They will also offer ASL and closed captioning.

To determine if you live/work within the relevant zone, please see the map below, which generally shows the area between Nanaimo and Boundary, and between 1st Ave and 22nd Ave.

The Renfrew Rupert Station Area Plan is a policy document that will shape the short and long-term growth in the area. The area plan will help to:

• Advance reconciliation

• Add new housing options close to transit

• Make it easier to walk or roll through the area

• Protect Still Creek and manage flood risk; and

• Support job growth.

The City of Vancouver are interested in hearing about your experiences in the neighbourhood (what is special, what is missing, what services do you use, what areas are problematic, etc.). They will have a group mapping activity as well as a questionnaire. The City of Vancouver will provide some material in advance of the workshop, such as questions for discussion and more background information on the area plan.

Disability Alliance BC is helping to organize participation in this workshop. The City of Vancouver and Disability Alliance BC respect the privacy of interested participants and wish to assure that any feedback received during the workshop will not be connected or recorded in any way so as to identify any specific person.

If you would like to attend, please email feedback@disabilityalliancebc.org with the subject heading: “Rupert and Renfrew Workshop” and include your name and mailing address, which will be used to mail your honourarium after the workshop. If you are unable to provide a mailing address, Disability Alliance BC can arrange to have your honourarium picked up at our office in downtown Vancouver.

A maximum of ten participants will be selected to join this workshop. Only selected participants will be contacted for further details.

Update: Inquiry into Hate in the Pandemic

72% of survey respondents in BC’s Office of the Human Rights Commissioner’s Inquiry into Hate During the Pandemic did not report hate incidents to any individual or organization, including police. 68% said they didn’t think a report would make a difference.

If people don’t feel served by the system we have, we must find a new strategy to address hate incidents. Everyone deserves to feel heard and confident that there are supports available and structures in place to address hate.

The public survey for BCOHRC’s Inquiry into hate in the pandemic has now closed and is moving into its next phase before final recommendations for change in 2023. Explore written and video submissions made to the Commissioner from individuals and community groups across B.C. at https://hateinquiry.bchumanrights.ca/documents/. #HumanRights4BC #BCPoli